Navigating the administrative process of vehicle ownership can be a challenge anywhere in the world, and in South Sudan, it's no different. The annual road tax is a mandatory fee that every vehicle owner must pay to ensure their car is legally allowed on the roads. While the process may seem daunting, it is straightforward once you know the required steps and documentation.

This guide simplifies the procedure, breaking down the process of paying your South Sudan road tax into seven clear and easy-to-follow steps.

Your Step-by-Step Guide to a Smooth Process

-

Gather Your Documents: Before you head to the office, ensure you have all the necessary paperwork. This typically includes your vehicle's original registration book, a valid vehicle insurance certificate, your National ID card, and any previous road tax receipts. Having all documents ready is the first and most critical step.

-

Visit the Traffic Police Office: The annual South Sudan road tax is managed and collected by the Traffic Police, usually at their main headquarters in Juba or designated regional offices. This is where you will initiate the process. Be prepared for a wait, and visit on a weekday morning for the best results.

-

Present Your Vehicle for Inspection: In many cases, an officer will perform a quick visual inspection of your vehicle to ensure its details match the paperwork. They will check the chassis and engine numbers, so make sure they are clearly visible.

-

Submit Your Paperwork: Hand over your documents to the designated clerk or officer. They will review everything for accuracy and validity. This is when your existing registration book and insurance certificate will be cross-referenced with your personal identification.

-

Get the Fee Calculation: Once your documents are approved, the clerk will calculate the tax amount due. The fee for South Sudan road tax is typically based on the vehicle's type, engine size, and age. The clerk will provide you with a payment slip showing the exact amount.

-

Make the Payment: With your payment slip in hand, you will be directed to a specific cashier or bank window to complete the transaction. Ensure you get an official receipt for the payment. This receipt is a vital piece of proof. For more insights on regional vehicle regulations and services, you can explore resources like those available at AfriCarGroup.

-

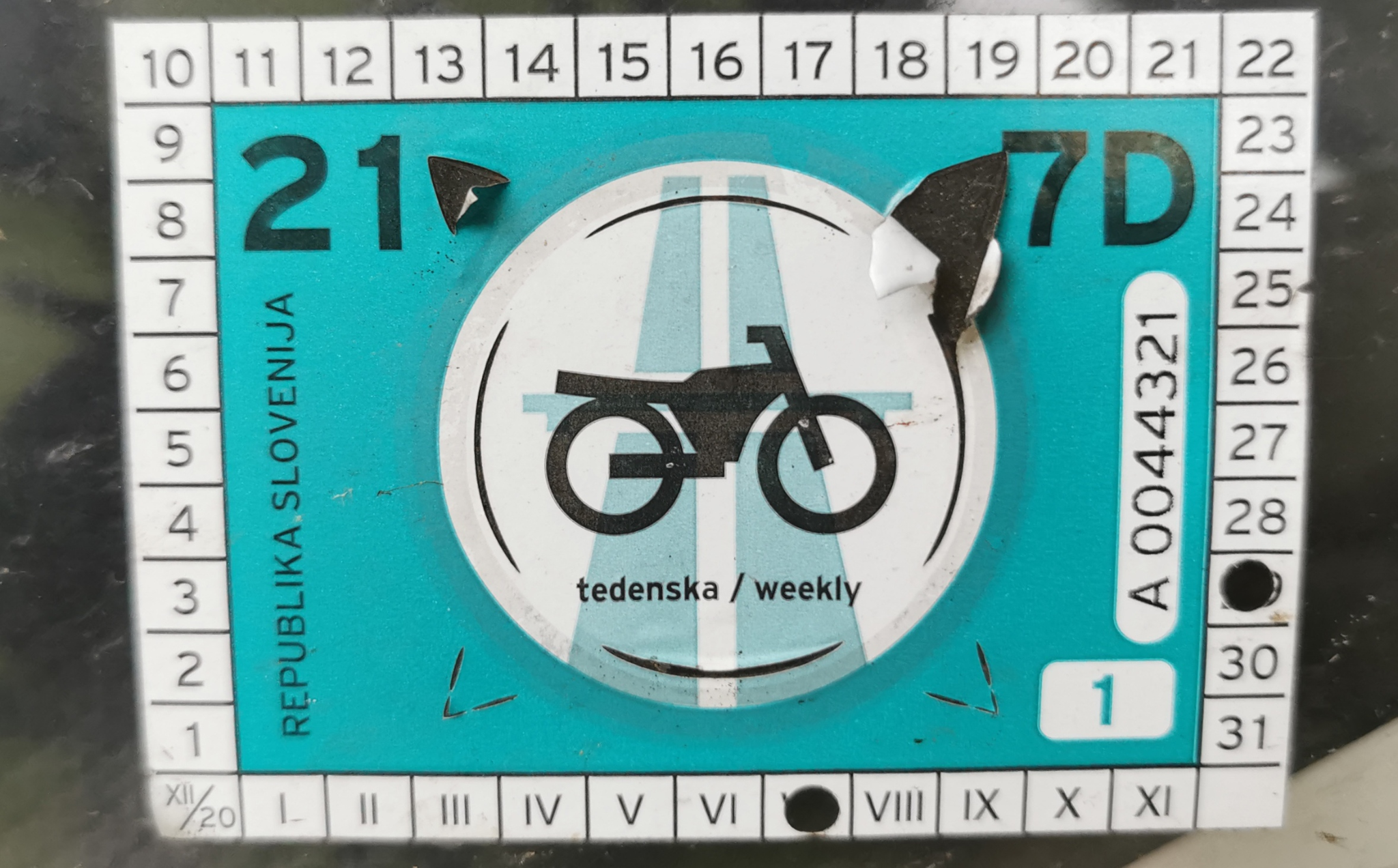

Receive Your New Tax Sticker: After paying, return to the clerk with your receipt. They will then issue a new road tax sticker, which you are required to display on your vehicle’s windshield. This sticker is proof of payment and is routinely checked by traffic police.

Following these seven steps ensures that your South Sudan road tax is paid properly, allowing you to drive with confidence and peace of mind, knowing that your vehicle is fully compliant with the law.

What was your experience paying road tax in South Sudan? Share your tips and insights in the comments below!